Computer Age Management Services Decoded

- Galactic Advisors

- Aug 18, 2020

- 7 min read

Updated: Sep 3, 2020

If you have ever opened a mutual fund account, chances are there you would have heard of CAMS/Karvy - the RTA (Registrar and Transfer agent) of mutual funds.

If you want to understand more about the company and the industry it operates, go on and read the notes below.

IPO Filings/DRHP’s are some of the best places to learn from when you are trying to understand the company and industry it operates in. In this letter, we will delve into the IPO filing of CAMS (the largest RTA in the country)

Introduction:

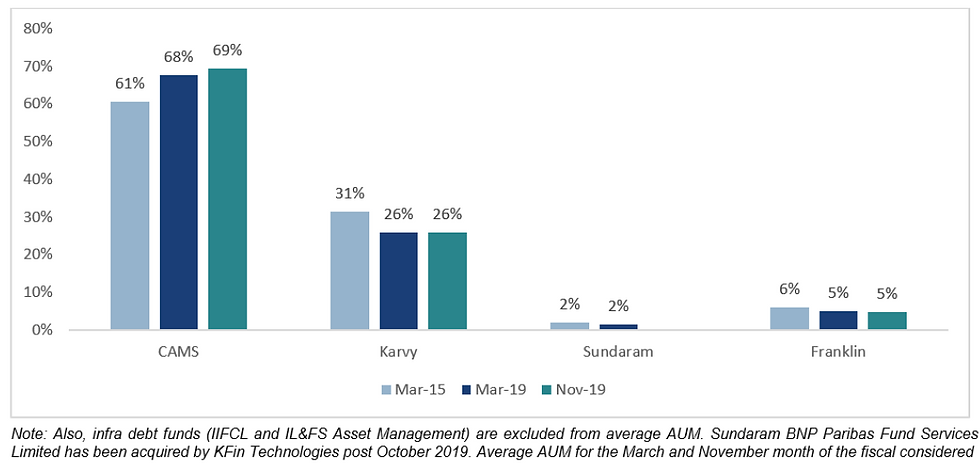

Founded in 1998, CAMS ( Computer Age Management Services Pvt. Ltd ) is India’s largest registrar and transfer agent of mutual funds with an aggregate market share of 69.4% based on mutual fund AUM managed by its clients (Asset Management Companies) during November 2019

This IPO is an offer of sale .i.e. the proceeds from the IPO will be going only to the existing shareholders selling their shares.

Shareholders

Growth Drivers:

Growth in the mutual fund industry on back of increasing savings moving towards financial assets:

India’s mutual fund AUM as a % of GDP is significantly lower than the world average:

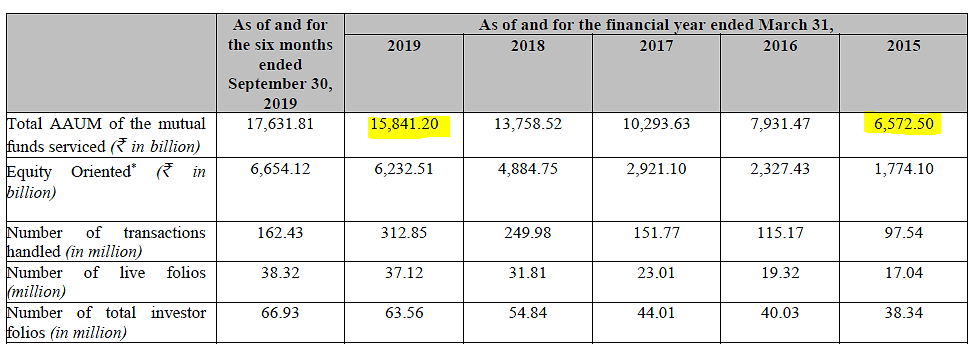

The number of mutual fund houses have been largely stable over the last few years, hence, the growth in the revenues will be largely on back of growth of AUM managed by the fund houses.

Mutual fund industry comprises of 41 AMCs (excluding Infrastructure Debt Funds) and a majority of the total mutual fund AUM is managed by the top five AMCs which have approximately 60% of the total market share as of March 2019. (Market share of top five AMCs has risen in the last few years from 54% in financial year 2015 to 58% in financial year 2019)

Services provided by RTA’s to AMC’s:

Knowledge partner of AMC’s: Given the history of RTA’s association with AMC’s, they apply analytics to accumulated data and help AMCs in the development of innovative products

Service aggregator: RTA’s bring cost efficiency to the table due to having similar scope of work across major AMC’s (e.g. sending notifications to the customer)

Operational Integration & Customer Care: Onboarding customers, maintaining records, data upgradation

Revenue Model:

Revenue is derived from fees charged for servicing the AAUM (average assets under management ) of the funds serviced by CAMS

Charge higher fees for equity mutual funds v/s debt funds

Contracts with Mutual fund and AIF clients are typically perpetual in nature, unless terminated by either party while it is 3-5 years for other clients

Major part of the revenue earned (estimated to be over 80%) is by means of tiered fees charged on the AUMs managed for which the MF RTAs provide service. These tend to decrease as a proportion of total AUMs once the AUMs surpass the tiers for which the fees are agreed on. Fees charged by RTA’s to Mutual Fund houses:

With the increase in AUM managed, the fees charged as proportion of AUM has been falling, but the extent of decline in pricing despite the strong growth in AUM (i.e. approximately a 30% CAGR) indicates the reasonably strong bargaining power enjoyed by MF RTAs

In FY 2020, MF RTAs witnessed some pricing pressure, as the SEBI reduced the total expense mutual funds were allowed to charge.

According to CRISIL, a moderate reduction in fees charged by RTAs as a proportion of AUM as the size of industry AUM increases is expected. However, RTAs will benefit from an expected increase in the share of equity and hybrid funds in industry AUM.

There is no impact of direct plans growth on RTA’s as RTAs as these are charged based on AUM,irrespective of which plan is opted for by investors

RTA’s also offer similar services to Alternate Investment Funds (AIF)

In addition,RTA’s also have offer similar services to insurance companies for policy servicing of e-insurance policies. There are 4 insurance repositories in India :

CAMS Insurance Repository Services Limited;

Central Insurance Repository Limited;

KARVY Insurance Repository Limited; and

NSDL Database Management Limited.

Competitive Landscape

Following are the are the mutual fund registrar and transfer agents operating in India:

Computer Age Management Services Limited (“CAMS”),

KFin Technologies Private Limited (erstwhile Karvy Fintech Private Limited) (“Karvy”)

Sundaram BNP Paribas Fund Services (acquired by Karvy in October 2019)

Franklin Templeton Asset Management (India) Private Limited

Source: Internet and IPO prospectus

CAMS services the 4 out of the top 5 AMC’s and 9 of the 15 largest AMC’s. It has been able to manage and hold on to its market share in the last few years:

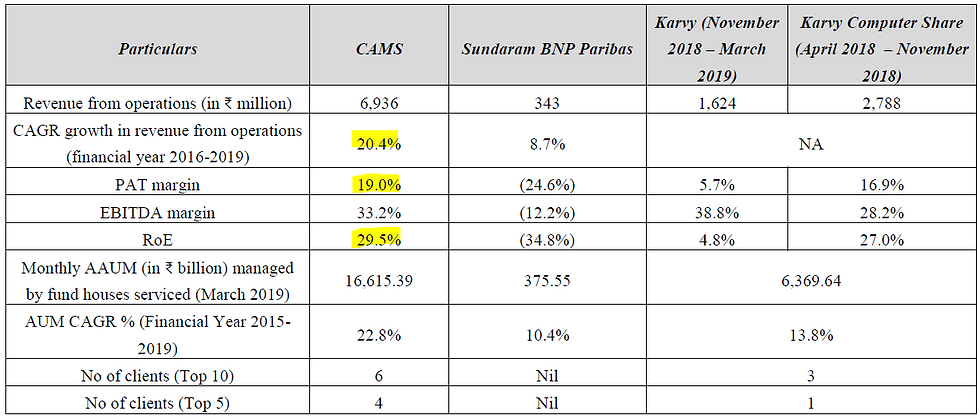

CAMS is the clear leader vs/ peers in profitability with RoE of 29.5% , PAT margin of 19% and witnessed the revenue CAGR of 20% over 2016-19.

CAMS also has a 3X higher business per branch despite having only 22% higher number of branches than Karvy

There are multiple reasons for the oligopolistic nature of the RTA industry leading to significant entry barriers:

High client stickiness due to humongous hassles involved in migration ,business disruption , customer and regulatory hassles . New players have not gain traction, only consolidation or building in-house RTA have led to switching of RTA’s - this is evidenced by the CAM’s number of clients being the same over the last 5 years:

The average term of CAM’s relationship with its ten largest mutual fund clients is 18 years as of September 30, 2019

High Technology intensity requiring continuous up gradation of systems due to changes in regulations

Need of extensive branch network to address service needs of customers

High operating leverage: RTA helps in addressing investor and distributor needs which are not addressed online

CAMS also has a significant presence in insurance repository market: Given the miniscule penetration of e-policies, there is a significant headroom for growth in this market.

Risks:

Regulatory Risk : SEBI in its press release in September and October 2018 had provided a maximum cap on the Total Expense Ratio (TER) which can be charged by mutual fund companies on the various type of products . This capping can potentially impact the revenues of service providers like CAMS since the AMC’s can renegotiate their fee contracts with CAMS

Client concentration Risk: Top 5 clients have contributed to 65-67% of revenues in last 4 years. Given the Oligopolistic nature of the market, the client concentration doesn’t seem to be reducing soon.

Consolidation in Industry: M&A in AMC’s can reduce the number of clients and grant more bargaining power to the AMC. In the past, they lost one of mutual fund clients’ due to their merger with another mutual fund that was serviced by a competitor

CAMS Overview:

Provides portfolio of technology-based services, such as transaction origination interface, transaction execution,payment, settlement and reconciliation, dividend processing, investor interface, record keeping, report generation, intermediary empanelment , brokerage computation and compliance related service

Also provide certain services to alternative investment funds, insurance companies, banks and non-banking finance companies.

Managed mandated transactions (collections , reconciliations) for AMC,s NBFC’s etc

For Insurance companies - processing of new applications, holding policies in demat form, servicing and support for policies

Digitization of account opening, back office processing for banks and NBFC’s

Number of folios serviced by CAMS are 38.3 million as of September 30, 2019

Has 278 service centers, four call centers, four back offices of which three are in Chennai

Business Structure:

CAMS in the process of winding down the operations of Sterling Software (Deutschland) GmbH.

CAMS operates in 7 business verticals namely: Mutual Funds Services Business, Electronic Payment Collection Services Business, Insurance Services Business, Alternative Investment Fund Services Business, Banking and Non-Banking Services Business, KYC Registration Agency Business and Software Solutions Business

Mutual Fund vertical services

Transfer services like transaction origination , managing KYC , execution of transaction processing from investors and payments, calculation & payment of brokerage commission fees to distributors, risk management services like reporting to SEBI, anti money laundering services, Customer care services through service branches for customer and distributors and call centre

Distributor services like record and maintenance of brokerage structures , computation of payable /clawback brokerage/ distributor queries

Also has developed a bunch of applications including mobile apps and solutions for investor, corporate and AMC needs

Electronic Payment Collection services:

Manage end-to-end automated clearing house transaction and electronic clearance services and service mutual funds, non-banking financial companies and insurance for automated payments

Insurance services:

Scrutinizing and processing of applications, training and onboarding of new insurance agents, submission of proposals, scanning, indexing and data entry, reminding policyholders of payment receipts

Alternative Investment Fund Services:

Similar to MF

Banking and Non Banking Services

Customer interface and back office processing

KYC Registration Agency Business:

Maintain KYC records on behalf of capital market intermediaries registered with SEBI, eliminating the need to repeat KYC procedure.

Software Solutions Business:

Software solutions business through subsidiary, SSPL which owns, develops and maintains the technology solutions for mutual fund clients, with a team of 362 people .

Employees:

As of September 30, 2019, CAMS employed 4,314 full time and 2,136 contractual employees.

Given the high operational intensity of the business, employee expenses is the major cost at ~38% of the revenues.

Dividend Distribution Policy:

Company adopted a formal dividend policy on February 20, 2018 which was further amended on January 2, 2020.

Company aims to distribute a minimum dividend of 65% of the consolidated profit, net of tax, for relevant financial year

Notes on financial information:

Nearly 254 Cr investments in mutual funds , 45 Cr of trade receivables, 157 Cr of cash & cash equivalents as of HYFY19

No debt on the books, just long term lease liabilites of 105 Cr as of HYFY19

Bulk of the revenues is from data processing:

Data processing comprises of core AAUM based revenue, revenue from services to insurance companies, banking and non-banking financial services companies and services to alternative investment funds and our KYC registration agency business.

Customer care services primarily comprise paper transaction volume-based fees and NACH volume based fee from electronic payment collection services business.

Recoverables comprise out of pocket expenses incurred on clients

Miscellaneous services comprises revenue from call centre services and fees for applications made available to clients. Software license fee, development and support services comprises fee earned by Subsidiary, SSPL for providing services to external clients.

Major part (~50%) of the operating expenses is the service expenses

Service expenses: Out of pocket expenses incurred for communication services to investors or distributors, stationary and postage on behalf of clients

Data entry expenses: primarily incurred to process paper applications in mutual fund services business

Customer service centre charges: Expenses primarily associated with management of service centres and payment of fees to centre heads

Claims: Incurred on account of claims raised against CAMS as well as funds set aside by CAMS to provide for future claims

There is no debt on the books of the company or its subsidiaries

Valuation :

Company is seeking to sell 1500 Cr-1600 Cr valuing the company at nearly 6,000 Cr

At current share capital of 48,760,000 shares, this translates to a price of 1230/- , meaning a current P/E of 36x on FY20E

The estimated returns for the selling shareholders is depicted below:

Please note that Great Terrain (Warburg Pincus) had acquired shares in the company only in 2018/19.

Other comments:

Given that the growth in the CAM’s business with be primarily driven by the clients’ AUM growth , unless CAMS acquire more clients (which looks difficult to high entry barriers) and low pricing power, the earnings growth in the future will be largely in line with industry AUM growth.

Note: All the notes are based on the filed CAMS IPO prospectus , please consult your financial advisor for advice before investing in any product.

Disclaimer: This post originally was written by Pratik Sahu and appeared on Compounding Wisdom has been reproduced here (with certain minor edits) with his kind permission. Also note that this post should not be construed as investment advice from Galactic Advisors.

Comments